We’re all familiar with the concept of a Last Will and Testament, the document that determines what happens to our estate after we pass away. But what many of us haven’t really stopped to think about is: what happens if we don’t go through the steps to properly plan?

What happens if you pass away without a Will or Trust? Or any Estate Plans at all? If this happens, the distribution of your assets will be decided in court, leaving your entire legacy to the fate of nothing more than a detached, convoluted, costly and often lengthy legal process.

It’s as simple as this: if you die without a Will (known as dying “intestate”), your loved ones will be facing a process that’s difficult, at best, to navigate.

To help you better understand what intestate is and why planning for your future is important, we’re covering everything you need to know about the importance of proper Estate Planning, and why you do not want to die intestate. We’ll go over:

What Does “Intestate” Mean?

If you’ve never heard the term before, intestate simply means you pass away without having prepared a Will. When this happens, there’s no legal document to determine how your estate and assets should be divided. The decision to control and divvy up your estate and assets then rests on legal procedures rather than your wishes.

Keep in mind that even if you have a Will, it will still go through what’s known as probate, but with your Will guiding the process, things tend to be much cleaner, simpler and faster.

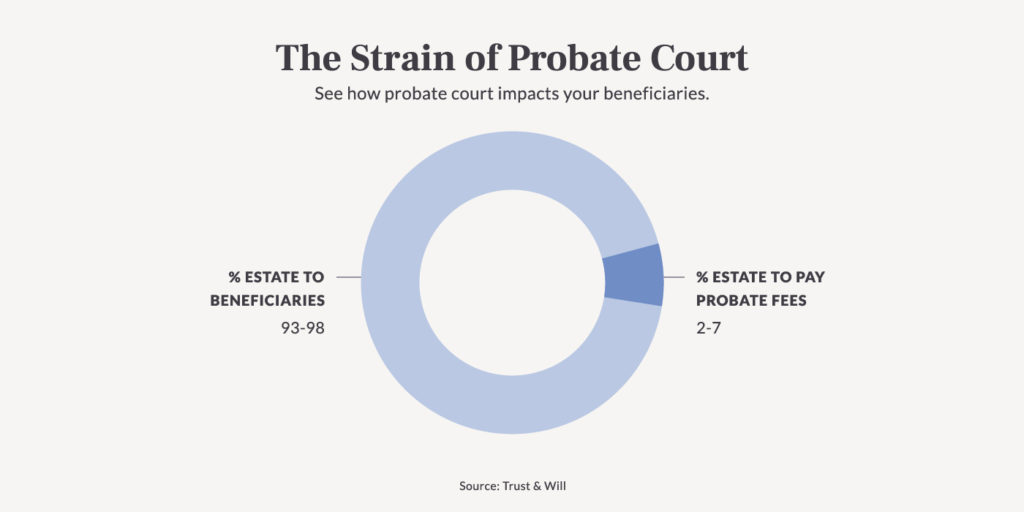

A probate court has the jurisdiction and competence to deal with the administration of estates. Probate courts handle the “probate” of wills, guardianship, conservatorship and estate administration. And, in cases of intestate deaths, they oversee the handling of those estates, too.

State Intestacy Laws

Intestate laws are governed by the laws of the state where you reside. Depending on the level of intestate (whether you have a Will at all, or if your Will is simply unclear or assets are missing), all bank accounts, real estate, annuities, life insurance proceeds and more could be at risk of going to the wrong person. Simply put, if you die without a Will, the state makes a Will for you. When an estate goes through probate, an inheritor must file a petition to justify why they have a claim to the estate. To further complicate things, multiple people can file a petition. In cases of intestacy, based on all the information in the petitions, and any remaining documents, the court will make a decision on how the assets will be distributed.

The Differences between Intestate and Probate

People often mistakenly use the words intestate and probate interchangeably. But in reality, the terms mean two completely different things. Dying intestate is very different than your Will going through probate.

Intestate, as we’ve discussed, means a person passes away without a proper Will in place. Their assets will go through the probate processes. However, since there is no documentation to direct the judge as to who should be considered a Beneficiary, state law will be used to decide on the distribution of all assets. You have no control over who gets what from your estate.

Probate is a court-supervised procedure that determines the organization of a deceased person’s assets, taxes and debts owed and the distribution of remaining assets to Beneficiaries. Whenever a person passes, Will or not, their estate and assets in the Will go through the probate process.

The Challenges of Intestate Deaths

Probate laws vary between states. You would have to research the specific laws that govern the state you (or a family member) resides in to fully understand the potential pitfalls of dying intestate.

Normally, when a person passes with a Will, the Executor will guide the assets through probate (also referred to as probate estate). But in the absence of a Will, there obviously will be no set Executor or Personal Representative established. In this situation, states will make arrangements on behalf of the deceased and the deceased’s family. For example, if you die without a Will, most states will gain control in order to distribute your estate assets as well as establish funeral arrangements. The state will then distribute the estate based on intestate succession laws.

Typically, if you have a surviving spouse with no surviving parents, children or grandchildren, your spouse will get your entire estate. If you’re living common-law and do not have a surviving spouse, in most cases, your partner would not receive any assets.

If you have surviving heirs, your estate would likely be split amongst all of them. This may be the case even in estranged or blended families. Intestacy laws determine the order in which an heir inherits an estate.

Even if you die intestate, there is the possibility that some of your assets will be distributed to Beneficiaries appropriately. This could be the case with life insurance policies where you have named a Beneficiary, or in the case of some retirement accounts, joint bank accounts, bank accounts that are “Payable on Death” or “Transfer on Death” (POD/TOD), or with jointly-owned property and securities.

How to Avoid Dying in Intestacy

The thought of dying before you’ve completed your Estate Planning can be stressful. You’ll be leaving the distribution of personal assets and your entire legacy at the hands of the legal system. Dying intestate means nobody will ever know what your wishes were - and even if they do know, they can’t prove it. Their information means little to nothing to a court of law without the proper documentation.

The only way to avoid dying intestate is to establish a solid Estate Plan that includes a Will and a Trust, among other important documents. You can start your Estate Plan with the help of an Estate Planning attorney (which can be costly and time consuming), or you can use a professional, trusted online legal service like Trust & Will.

By establishing your Last Will and Testament and other parts of your Estate Plan, you can ensure your estate and assets are controlled by people you trust. You can also feel confident your dying wishes will be known and respected. You can ensure that your spouse, children and any other loved ones are well taken care of.

Properly, fully and legally preparing your Will is so important. Even if you’ve started the process, keep in mind you should update your Estate Plans regularly. While there’s no hard and fast rule about how often you should review your Estate Plan, a good rule of thumb is to do so any time you experience a major life event - a marriage, divorce, birth, death, when your children become legal adults...all of these significant times in life are good times to review your documents and make sure your estate is in good order. Remember - any portion of your estate that isn’t appropriately accounted for in your Trust or Will could end up intestate.

Without a Will, in addition to the time, cost and added stress and grief for your loved ones, it’s also very likely that your assets will not end up where you want them to go. There’s no better time than right now to make sure your Estate Plans are in order.

If you’re ready to start or update any part of your Estate Plan, from your Will, to your Trust, to Guardianship, to Healthcare Directives and more, reach out to Trust & Will today. Our process is streamlined, simple and affordable. So there’s really no reason for you to not do it.

Share this article