You've probably heard the terms "Will" and "Trust" from an Estate Planning perspective, but do you really understand the difference between each? And even more, do you know which Plan will best protect your family and assets?

There are many Estate Planning options out there and deciding on the right path to take can feel overwhelming. Lucky for you, Trust & Will is here to help. We're a team of Estate Planning experts dedicated to helping as many people as possible find a plan that meets their needs and makes the most sense based on their current stage of life. From the slight nuances to significant differences, we'll break down everything there is to know about Wills and Trusts in Estate Planning.

Preparing for your future and making these important decisions now is the best way to make things easier on your loved ones when they'll need it most.

Keep reading to learn the differences between a Trust and a Will. Our complete guide will cover:

Will vs Trust

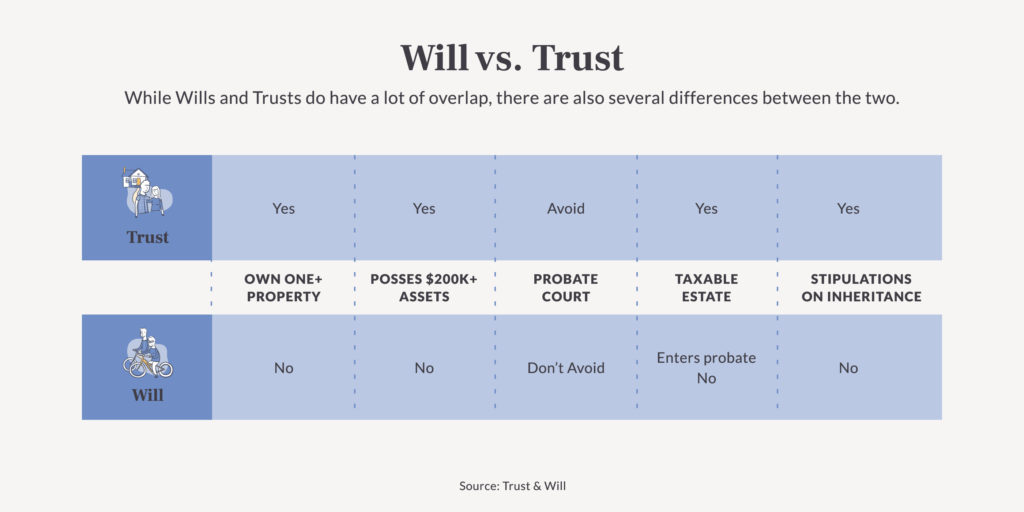

While Wills and Trusts do have a lot of overlap, there are also several differences between the two. Ultimately, both are ways to say who will receive your assets. They just do it in different ways, and each has its own advantages and disadvantages.

One big difference between the two is in how and when they take effect. Wills don’t go into effect until you pass away, whereas a Trust is effective immediately upon signing and funding it.

It may be easier to think of a Will as a “simple” document. Wills allow you to:

Name guardians for kids and pets

Designate where your assets go

Specify final arrangements

While it is an easier process, the simplicity of a Will does come with some drawbacks. For example, Wills offer somewhat limited control over the distribution of assets. They also most likely have to go through some sort of probate process after you pass away.

A Trust is a bit more complicated, but can provide some great benefits. Trusts:

Offer greater control over when and how your assets are distributed

Apply to any assets you hold inside the Trust

Come in many different forms and types

Keep in mind that after you create a Trust, you also need to fund it by transferring assets to it, making the Trust the owner. This does make Trusts a little more complex to set up, but note that Trusts have one major benefit over Wills. They’re often used to minimize or avoid probate entirely, which is a huge plus for some people. This alone could more than justify the additional complexity of setting up a Trust.

Will or Trust - Which is Better?

When we’re talking about Wills vs. Trusts, we need to keep in mind that they have very different and specific benefits. It’s not really accurate (or helpful) to assume one is “better” than the other. You should start by assessing your situation, your goals and your needs at the very beginning of the process. Only then can you find the solution that best-suits and protects your family in the most appropriate way.

Can You Have Both a Will and a Living Trust?

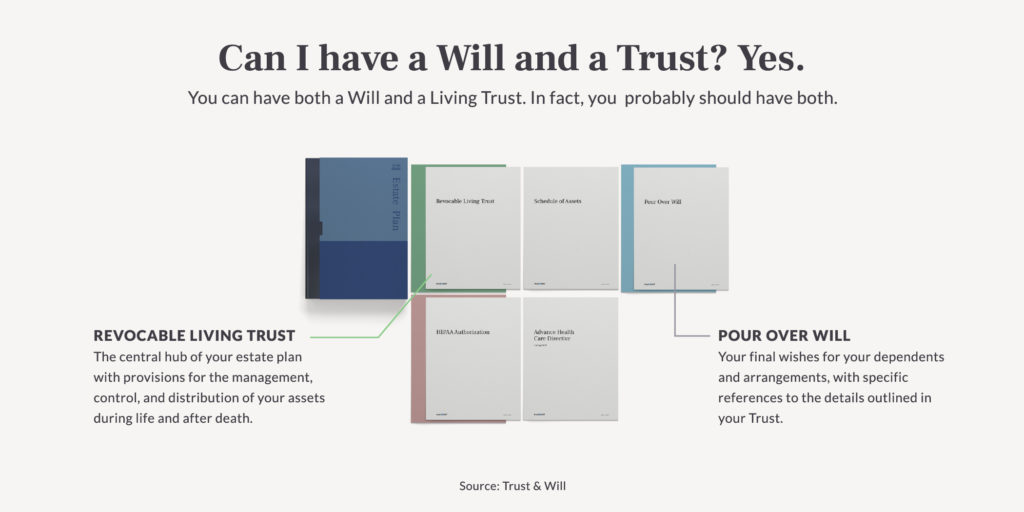

Short answer: Yes, you can have both a Will and a Living Trust because they do two different things. Trusts provide for the management and distribution of your assets during lifetime and after death. A Will, on the other hand, allows you to do things like name guardians for your children, appoint an executor for your estate, and declare your final wishes. So what’s actually more crucial to understand is the type of Will to have with a Living Trust so that you can have the most comprehensive Estate Plan.

Let’s say you have both a Last Will and a Living Trust. This is not necessarily recommended and here’s why: The assets that are included only in your Last Will will likely have to go through an extensive probate process. Not to mention, Last Wills are public documents. Conversely, the assets included in a Trust are typically protected from probate court..

Enter: The Pour Over Will. Most Revocable Living Trusts (including the one you can purchase through Trust & Will) include what’s called a Pour Over Will, which is a type of Will designed to work in conjunction with your Trust. With a Pour Over Will, anything a person owns outside of their Trust — as well as anything that is subject to their Last Will — will be paid to your Trust at the time of your death. Pour Over Wills essentially act as a backup plan to ensure all of your assets go under your Trust.

Note that a Living Will is also different from a Last Will and a Pour Over Will (and yes, we know the names can get confusing). A Living Will refers to a set of documents related to an individual’s medical decisions. Included in those documents are:

Medical Power of Attorney

Advanced Health Care Directive

HIPAA Authorization Form

When you become a member at Trust & Will, the documents included in a Living Will — listed above — are provided whether you opt to purchase a Trust or Will.

Do Wills Require Probate?

Just because you take the time to create a Will, it doesn’t mean your estate will avoid probate. Probate is the process your estate goes through after you pass away if you haven’t done proper or comprehensive Estate Planning. It is a court-supervised proceeding, and depending on how solid your Estate Plan is, can be costly and take a long time.

However, there are many ways you can simplify, or even eliminate all together, the probate process. One of the most effective ways to make it easier on those you leave behind is by creating a Trust as part of your Estate Planning. Anything you put inside your Trust can be passed down while avoiding probate. And, a big benefit to having a Trust is distribution of assets remains private, whereas distributing assets through a Will and probate are public.

When do Trusts and Wills go into Effect?

As noted earlier, Wills do not go into effect until the moment you pass away. In contrast, a Trust is essentially in effect the moment you sign and and fund it.

Wills After Death

Your Last Will and Testament takes effect once you pass. At that time, someone must notify the court to begin the probate process. The subsequent events that take place in effort to settle your estate and distribute property and assets can take a long time and be expensive.

Another (rather big) point to consider is that since your Will only takes effect after you pass away, if you become incapacitated and unable to make decisions for yourself, you have no recourse or plan as directed by your Will. On its own, a Will is essentially useless while you’re alive. This means a Will, on its own, is not an effective end-of-life planning tool.

Trusts Impact Life and Death

Because a Trust instantly takes effect as soon as you sign it, it can simplify the process for those around you. But it’s very different from a Will in that your Trust not only plans for after you die – it’s a document intended to have an impact while you’re still living. A Trust can set provisions for things like what you want to have happen if you become mentally or physically unable to make your own decisions. It protects loved ones from having to make decisions about the unthinkable. Most importantly, a Trust can make sure your wishes are known, during your lifetime and after you pass, so the stress of wondering what you would want can be completely removed from the equation.

Planning for the future is important on so many levels. But it’s not lost on us that the process can seem overwhelming – where do you even start?

There are a lot of pieces to the puzzle, and too often people think “I’ll get to it later…” That’s risky. If you become unable to make decisions on your own, and you haven’t put a plan into place, all that burden and stress will fall on your loved ones as they try to make decisions for you, hoping they get it right. Creating an Estate Plan is a true gift to your family and friends.

Fortunately, you don’t have to go at it alone. Trust & Will is there for you every step of the way. We’ll help you choose the right Estate Plan for your exact situation, with your goals in mind.

Want to learn more about the differences between a Trust vs Will? Chat with a live member success representative or Take our simple quiz designed to match you with the perfect plan. The peace you’ll gain from setting up your future is worth it, trust us. Get started today, worry less tomorrow.

Share this article