In easiest-to-understand terms, probate is simply the legal procedure your estate goes through after you pass away. During this legal proceeding, a court will start the process of distributing your estate to the proper heirs.

[Need help with probate? We offer helpful probate services and will work with you to find the plan that meets your needs.]

Probate is always easier if you have a Will and/or Living Trust that clearly defines your wishes. These documents help most by naming your Beneficiaries and an Executor. An Executor is the person charged with overseeing your final wishes.

If you have mindfully prepared an estate plan, you’re smart. Creating a Will or Living Trust makes a difficult life-event just a little easier on your loved ones.

It’s important to understand that your Will still must go through probate, but it’s so much simpler when you have planned ahead. During probate, a court will first authenticate your Will, and then authorize your Executor to pay all debts and taxes and distribute your remaining property accordingly, per the instructions you leave. You probably have many questions about probate, so read on to learn everything you need to know.

In this guide, we’ll cover:

What is Probate?

Probate is a court-supervised proceeding that authenticates your Will (if you have one) and approves your named Executor so he or she can distribute your property and belongings. During the probate process, all your assets must be located and assessed for total value. Once that is done, taxes and debts are paid and the remaining value of the estate is distributed.

In cases where there is no Will (meaning your estate is intestate), this process obviously becomes more complicated. Because there is no documentation stating your final wishes, it is up to the courts to handle proceedings and make all decisions for you.

When is Probate Necessary?

Unless you properly plan, your estate will go through the probate process. That said, the process is greatly simplified, or potentially even totally avoided, when you have a solid Estate Plan in place. The more planning you do now, the easier it will be on your loved ones after you pass.

One way to lessen the burden and headache of probate, or even avoid it altogether, is by creating a Trust. Any assets you place into your Trust will bypass probate.

It’s easiest to think about probate as a supervised process that ensures the proper Beneficiaries receive the appropriate titles and assets from your estate. In cases where no Will or Trust is present, it is the court’s job to appoint someone to represent your estate. This Personal Representative will handle all the things an Executor would if a Will had been present. Some assets and property in an estate will always go through probate, while others (like those in a Trust) will not.

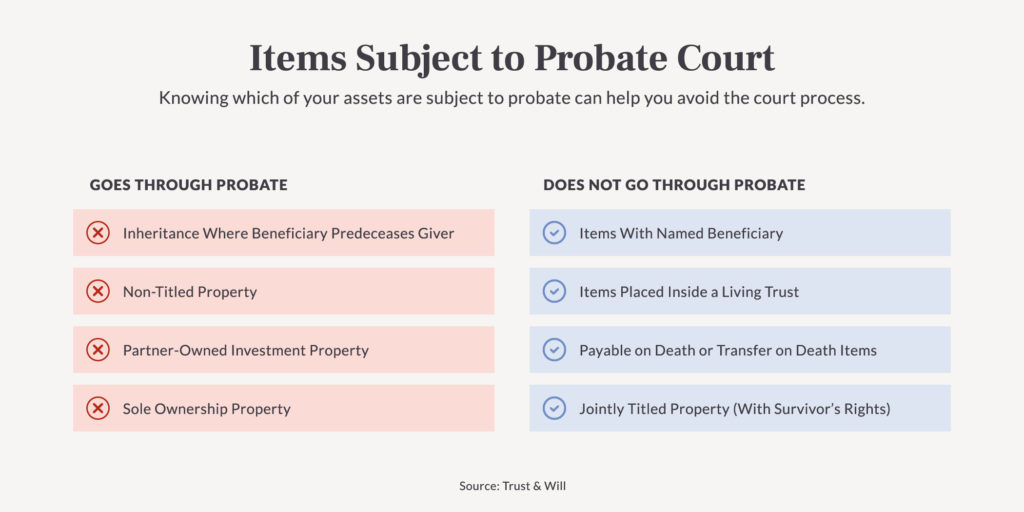

What Has to go Through Probate Court?

If you do not have a Will, everything you own will go through probate court. The following will always go through the process, regardless of what your Estate Planning states.

Any inheritance where the Beneficiary predeceases the giver: If a named-beneficiary passes away before you do and you fail to update your Will, the courts will become involved in deciding how to settle this part of your estate.

Non-titled property: Non-titled property is anything you own that doesn’t have paperwork. Household items such as appliances, clothing, furniture and other general items could fall into this category. If your Will names these items and appropriately states your wishes, you can eliminate probate.

Partner-owned investment property: In cases where properties are titled as “tenants in common,” and where clear instructions aren’t present in a Will, a probate court will step in to help determine how your share is passed down. Keep in mind, if your Will makes your wishes clearly known, the process becomes simplified.

Sole ownership property: Property that’s titled in solely in your name will go through probate to determine ownership. In some states, you can avoid this by adding “POD” (payable on death) or “TOD” (transfer on death) to the title or deed.

What Does Not Have to Go Through Probate Court

Certain assets and property will not go through probate. By properly planning, you can help avoid probate for any of the following.

Items that have a Beneficiary named: Naming a Beneficiary on an asset means you can avoid probate. For example, life insurance policies have named Beneficiaries, so proceeds go directly to them without having to go through probate.

Items placed inside a Living Trust: Because a Trust owns the items inside it, when you pass away, anything in your Trust can go to your Beneficiaries as specified by the Trust, thus avoiding the probate process.

POD (payable on death) or TOD (transfer on death) items: When you title property and assets such as bank accounts, real estate, retirement accounts, stocks and vehicles with “POD” and “TOD,” you can bypass probate and pay or transfer items directly to your noted Beneficiary. Note that some states do not allow real estate to be titled this way.

Jointly titled property (with Survivor’s Rights): Property titled jointly with Survivor’s Rights will automatically go to a Survivor after you pass. There is no need for the property to go through probate in this case.

What is the Probate Process?

How the process of probate plays out in court largely depends on whether or not you have a Will. The biggest difference is that when no Will is present, the court will appoint someone as a Personal Representative to oversee distribution of your belongings. In the absence of a Will, only the beginning of the probate process will differ. Once a Personal Representative is appointed, the rest of the process will be the same.

1. Death Certificate

Someone, usually your Executor or lawyer, will inform the court of your death and submit a copy of the death certificate to start the probate process.

2. Have the Will Validated

Your Will must be authenticated by the court to ensure it was properly signed and dated in accordance with the law. Once this is done, your Will is considered valid.

3. Select Someone to Conduct Probate

In cases where a Will is present, a judge formally appoints the person you name as Executor (only in very rare cases would the court overturn your choice). The Executor then oversees the process and settles your estate. If there is no Will, the court will appoint a Personal Representative for this role. Usually this would be your next of kin. A Personal Representative acts exactly as an Executor would.

4. Post a Bond

Posting a bond protects Beneficiaries against potential errors an Executor or Personal Representative might make during the probate process. Bonds may be quite costly, but your estate will pay for it. Bonds are not always necessary, as some states will waive them if your Executor or Personal Representative is also a Beneficiary of your estate. You can also include a request to waive a bond in your Will.

If you’re considering DIY Estate Planning, you can trust a source like Trust and Will. You’ll feel confident that some of the more obscure and less-known parts of the process (like needing to post bond) will be covered. Trust and Will knows the probate process inside and out, and our legal experts have taken the time to ensure that you address everything you need to in one place.

5. Inform Beneficiaries & Creditors

This is likely the biggest task most Executors or Personal Representatives will undertake. It involves finding and informing any potential Beneficiaries and possible creditors of your passing. He or she will also need to communicate with creditors to settle your debts using money from your estate.

Keep in mind that in cases where there is a Will, most, if not all, Beneficiaries will be named, so informing them is usually an easier task. Finding creditors can be more difficult and time-consuming, regardless of whether or not a Will is present. It should make sense that both parts of this process become exponentially more difficult when there is no Will.

6. Determine Value of Assets/Property

To determine the value of an estate, an assessment must first be completed. This will account for everything you own at the time of your passing. Sometimes, particularly in larger estates, a professional appraiser may be needed. This person understands the process of collecting and inventorying all real estate, personal and household items to assess their value. The total combined value is then used to estimate the value of your estate.

7. Pay All Fees and Debts of the Deceased

Funeral expenses are typically paid from your estate. Once this is paid, the estate will fund the payments for medical expenses, filing and paying taxes and handling other unpaid debts you may owe at the time of your death. This step needs careful attention, because there is potential for debtors to go after Beneficiaries in the future to recoup any unpaid debts.

8. Distribute Remaining Assets

After all the debts have been paid, any remaining assets will be forwarded to the appropriate Beneficiaries. The Executor or Personal Representative will transfer deeds and titles into the correct Beneficiary’s name, per the direction of the Will or the court.

The probate process can be lengthy and complicated, especially during a time of grief. If this is something you don't want to go through alone, consider getting help from our probate experts. They offer unparalleled support and guidance to simplify the probate process.

How to Avoid Probate

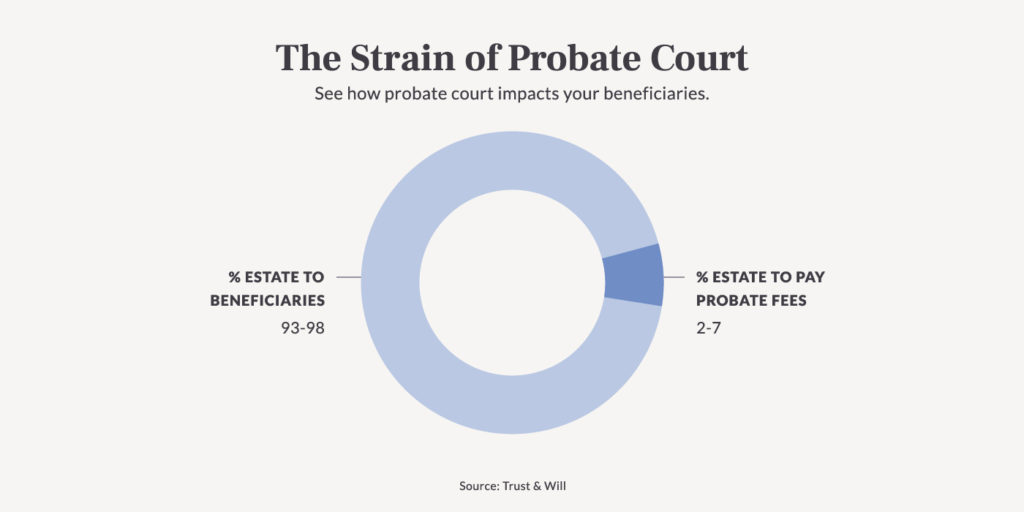

There are ways to limit the headaches that probate often causes loved ones. There can be several benefits to avoiding probate, including time, cost and privacy.

Without the presence of a Will, probate can take a long time (sometimes years). While cost can vary depending on your state, probate generally means Executor fees, administrative expenses and legal fees. The longer probate takes, the more fees there will be. And finally, one of the biggest reasons people may hope to avoid probate is for privacy reasons. Probate processes are public, but creating a Trust keeps the distribution of assets private.

There are several strategic ways you can minimize the stress and pressure of probate for your loved ones, including:

Establish a Living Trust. As we previously discussed, when you create and fund a Trust, you’re essentially making the Trust the owner of your assets. So when you die, the named Trustee manages, per your guidance, all the assets inside of it.

Give assets to loved ones while you’re still alive. Reducing an estate’s value can drastically simplify the probate process as well as potentially have positive tax advantages in terms of federal and estate taxes.

Keep your estate small. The majority of states have an exemption level that will at the very least allow for an expedited probate process in cases where estates are very small in size. You would want to check the maximum amount your state allows for (don’t be surprised if that amount is much higher than you anticipate – limits can be fairly high in some states).

Title accounts POD or TOD. This can work for bank accounts and some other assets. And in some (but not all) states, it is also a valid way to transfer real estate to Beneficiaries.

Title property jointly. Jointly owning property means assets can transfer from one person to another without having to go through the probate process. You can hold assets as:

Community property with the right of survivorship

Joint tenancy with right of survivorship

Tenancy by the entirety

Common Questions about Probate

How Long Does Probate Take?

Probate can take varying amounts of time, but in cases where estates are small and there are no hang ups, the average time to complete the probate process, could be less than a year. Six to nine months is not uncommon if everything is seamless and nobody tries to contest anything.

In complicated or contested situations, the process can take several years. In very extreme cases, it could even take decades before an estate is settled. While many factors go into the actual timeline for probate – such as presence or lack of a Will; size of an estate; disgruntled Beneficiaries; or complicated estates – one of the best ways to ensure a timely, easy probate is by properly and effectively Estate Planning.

How Much Does Probate Cost?

There are several costs involved in the probate process. Factors like if you have a Will, how big your estate is and where you reside at the time of your passing will all contribute to how much probate costs.

Expect the following costs:

Attorney fees: Depending on what state you’re in, an attorney may be required by law to handle probate. His or her fees would be paid out of the estate. Note that most states do not require an attorney.

Compensation for your Executor: The majority of states have a guideline for minimum Executor or Personal Representative compensation, such as 5 percent of the estate value. It’s no easy task, so compensating them for the time they’ll invest in settling your estate makes sense.

Probate bond: Also known as a Fiduciary or Executor Bond, unless your Will outright states this is unnecessary, some states require a bond to protect Beneficiaries. Bond companies will most often charge a percentage of the amount needed for the bond.

Court fees: Counties and states have individual filing fees, so the amounts here will vary as well, depending on where probate is filed.

Creditor notice fees: You must file notices in local newspapers and/or in other forms of communication to alert creditors and Beneficiaries of a death. There will be a cost associated with these announcements, and they too will be paid out of the estate.

What is Probate Real Estate?

If you do not have a Will and you own property at the time of your passing, the court will control the bidding and sale of your home.

What to Bring to Your First Probate Hearing

A court will schedule the first probate hearing to give interested parties a chance to object. In most cases, your Executor or Personal Representative will not need to be present at this hearing. The probate hearing allows the court to formally appoint the person who will oversee the distribution of assets and other aspects of settling your estate. The court will issue legal documents authorizing your Executor or Personal Representative to act on behalf of your estate. These documents can be referred to as a number of things, including:

Letters of Authority

Letters of Testamentary

Letters of Administration

What is a Probate Will?

When you pass away, your Will must go through probate to be authenticated and validated by the court. Not all Wills require a lengthy, complicated probate process. The majority of states have a way to simplify or skip probate when dealing with very small estates. And, remember that creating a Trust is a great way to avoid probate completely, making the entire process easier on your loved ones.

Creating a Will or Living Trust is a wise choice for many reasons. But perhaps the best outcome of doing so is the sense of relief it can provide. Knowing you’ve protected your loved ones as much as possible from the stress, cost, time and pain of probate is a weight lifted. Trust and Will makes the estate planning process easy, streamlined and affordable.

Let Trust & Will help probate your Will for you!

Share this article